News

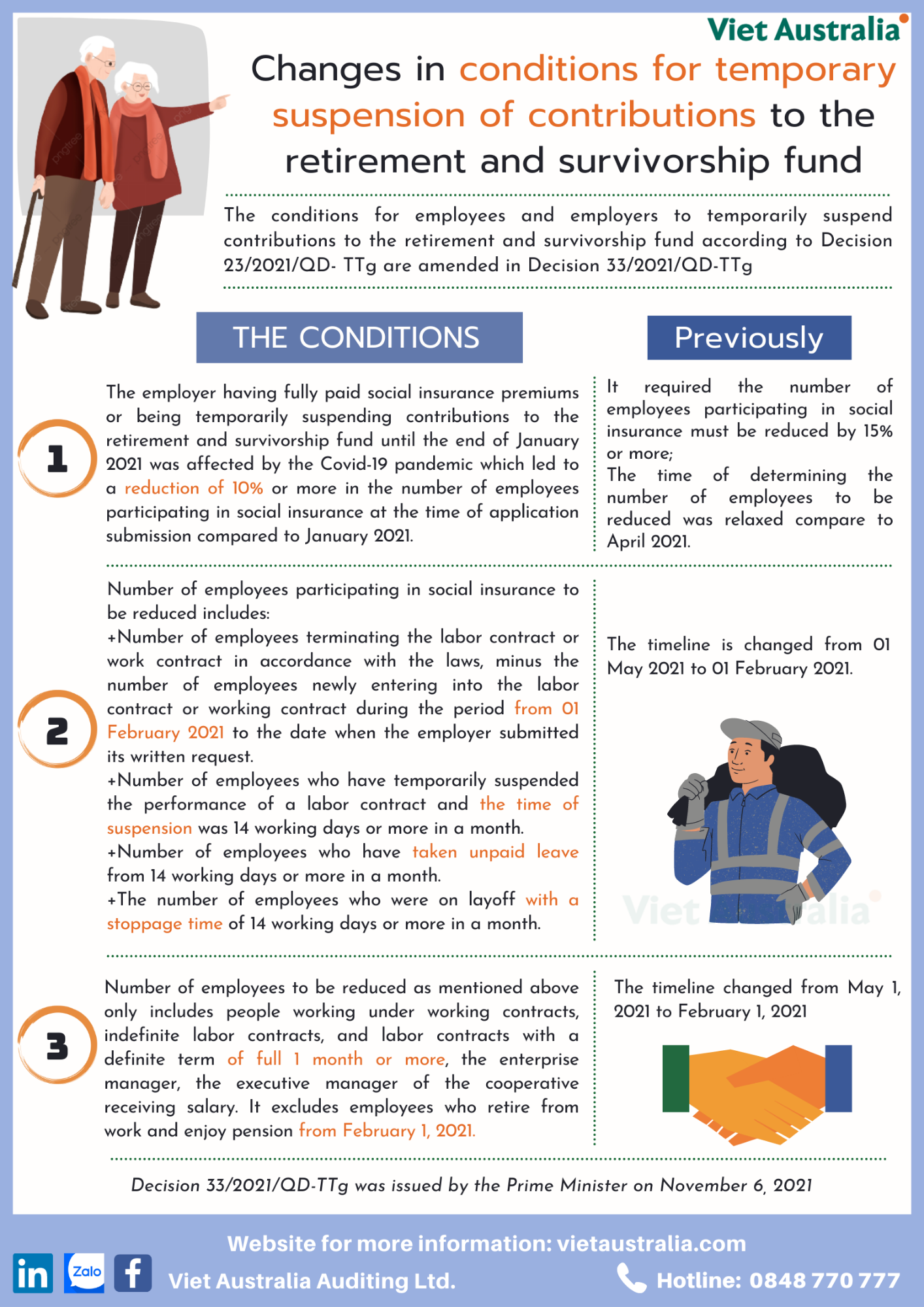

Changes in conditions for temporary suspension of contributions to the retirement and survivorship fund

The conditions for employees and employers to temporarily suspend contributions to the retirement and survivorship fund according to Decision 23/2021/QD- TTg are amended in Decision 33/2021/QD-TTg as follows:

The employer having fully paid social insurance premiums or being temporarily suspending contributions to the retirement and survivorship fund until the end of January 2021 was affected by the Covid-19 pandemic which led to a reduction of 10% or more in the number of employees participating in social insurance at the time of application submission compared to January 2021.

(Previously it required the number of employees participating in social insurance must be reduced by 15% or more and the time of determining the number of employees to be reduced was relaxed compare to April 2021).

Number of employees participating in social insurance to be reduced includes:

+ Number of employees terminating the labor contract or work contract in accordance with the laws, minus the number of employees newly entering into the labor contract or working contract during the period from 01 February 2021 to the date when the employer submitted its written request.

(The timeline is changed from 01 May 2021 to 01 February 2021 as compared to before).

+ Number of employees who have temporarily suspended the performance of a labor contract and the time of suspension was 14 working days or more in a month.

+ Number of employees who have taken unpaid leave from 14 working days or more in a month.

+ The number of employees who were on layoff with a stoppage time of 14 working days or more in a month.

Number of employees to be reduced as mentioned above only includes people working under working contracts, indefinite labor contracts, and labor contracts with a definite term of full 1 month or more, the enterprise manager, the executive manager of the cooperative receiving salary.

It excludes employees who retire from work and enjoy pension from February 1, 2021. (Compared to before, the timeline changed from May 1, 2021 to February 1, 2021). Thus, the conditions to stop paying social insurance contributions to the retirement and survivorship fund have been relaxed as compared to before, helping to expand the beneficiaries of this policy.

Decision 33/2021/QD-TTg was issued by the Prime Minister on November 6, 2021 and takes effect from the date of signing.