News

Missing VAS Regulations Compared to IFRS

Vietnam has recently issued 26 Vietnamese Accounting Standards (VAS), which is still significantly fewer compared to international standards. Some areas where VAS lacks alignment with International Financial Reporting Standards (IFRS) include standards related to agriculture, exploration and exploitation of mineral resources, financial instrument categories, fair value, and impairment of assets. Below, we will explore certain provisions where the Vietnamese Accounting Standards (VAS) system is deficient compared to International Financial Reporting Standards (IFRS).

Provisions Related to Revaluation of Assets and Liabilities at Fair Value, with Differences between Vietnamese Accounting Standards (VAS) and International Accounting Standards (IFRS)

The difference lies not in the initial recognition but in the subsequent evaluation and presentation of financial statements by enterprises.

According to VAS regulations, at the reporting date, most assets and liabilities are still recorded at historical cost, meaning they are not adjusted to fair value. Changes in fair value are not reflected, except in the case of revaluation of foreign currency-denominated balances.

In the case of trading securities, some argue that they have been revalued to fair value through the establishment of discount provisions. However, the establishment of discount provisions merely records one aspect of the fair value change (discount), which is not as comprehensive as the IFRS provisions.

In summary, these two accounting standards differ in how they recognize revaluation at fair value, and VAS is not as widely applied as IFRS in adjusting the value of assets and liabilities based on fair value.

Provisions Regarding Recognition at Present Value, Current Value, Amortized Cost, and Discounted Cash Flows at Effective Interest Rate: Another Difference between International Financial Reporting Standards (IFRS) and Vietnamese Accounting Standards (VAS)

IFRS allows certain assets such as receivables or loans to be recognized at amortized cost, based on the present value of expected future cash flows. This provides a more accurate representation of the true value of these assets.

While VAS 14 addresses this issue, there are no specific guidelines for implementing the recognition at present value, current value, amortized cost, and discounted cash flows at the effective interest rate. Therefore, this issue remains one of the clear differences between the two accounting systems.

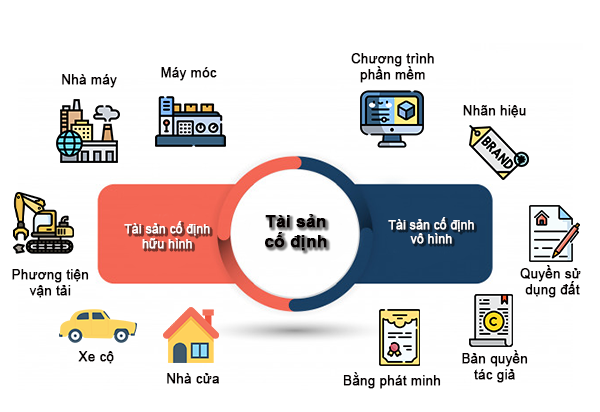

Provisions Related to Fixed Asset Accounting

- Historical Cost of Fixed Assets

IFRS allows the inclusion of future costs in the historical cost of Fixed Assets (FA), such as decommissioning costs or restoration costs of FA. However, VAS does not permit the inclusion of these costs as part of the components of FA.

2. Revaluation of FA at Reporting Date:

IAS 16 allows the revaluation of assets at the reporting date, with the increase recognized in equity after offsetting any previously recognized losses due to prior impairment. However, VAS 3 only allows revaluation in specific cases, such as decisions by state authorities, contributing FA to joint ventures, mergers, or spin-offs.

Provisions Regarding Recognition of Asset Impairment:

According to International Accounting Standards (IAS 36), assets like Fixed Assets (FA), Investment Properties (IP), investments in subsidiaries, associates, joint ventures, Biological Assets, Mining Rights, money-generating units, and Goodwill must be assessed and recognized for impairment (if any) in the income statement at the reporting date.

However, Vietnamese Accounting Standards (VAS) handles this differently under the Enterprise Accounting Regime and financial mechanisms. It allows provisions to be made for investments in subsidiaries, joint ventures, associates if these companies incur losses. Still, the value of the impaired investments may be higher than the losses recorded in the period of these companies.

The recognition of Goodwill is distributed over ten years under VAS, whereas under IFRS, the standard requires determining the impairment amount annually instead of allocating evenly.

In summary, there are differences between IAS 36 and VAS in assessing and recognizing impairment of these assets, and the treatment of these differences in Vietnamese enterprises' accounting is also different.

Provisions Regarding Lease Transactions:

IFRS 16 does not distinguish between finance lease transactions and operating lease transactions. Instead, it differentiates lease transactions and service transactions. This means that businesses record leased operating assets in the financial statements.

In contrast, VAS 6 still relies on the old IAS 17, so any changes introduced by IFRS 16 create differences between the two accounting systems.

To summarize, IFRS 16 does not clearly distinguish between finance lease and operating lease transactions, allowing the recognition of operating leased assets in the financial statements. Meanwhile, VAS 6 continues to comply with the old IAS 17 and does not implement the changes introduced by IFRS 16, leading to differences between the two accounting systems.

Provisions Regarding Business Combination Transactions:

1. Goodwill:

IFRS 3 requires the calculation of goodwill arising from the acquisition of a subsidiary for both the ownership portion and the non-controlling interest, while VAS 11 only requires recognizing goodwill for the ownership portion of the parent company.

In multi-stage business combination transactions, IFRS 3 specifies that goodwill is determined only once at the date of control. Goodwill must be determined based on the fair value of the subsidiary's net assets at the date of control, and the value of the investment previously measured at fair value at the date of control.

VAS requires determining the goodwill value as the total value of goodwill arising from each exchange. This means that the net assets of the subsidiary are determined at each exchange and do not require the reassessment of the fair value of the parent company's investment in previous exchanges.

In summary, IFRS 3 and VAS 11 differ in calculating goodwill when acquiring a subsidiary and determining the fair value of the subsidiary's net assets in multi-stage business combination transactions.

2. Non-controlling Interest (NCI)

IFRS 3 requires recognizing the non-controlling interest's share of losses even when these losses exceed the non-controlling interest's share in the subsidiary's net assets (i.e., the non-controlling interest's share may be negative). In contrast, VAS 11 only allows recognizing the losses that the non-controlling interest bears up to the value of the net assets they own (cannot be negative).

Other Transactions

Several transactions lack a basis for recognition due to the absence of regulations in VAS. Examples include:

- No basis for recognizing share-based payments, employee benefits.

- Biological assets and agricultural products are currently presented either with or as part of inventory or fixed assets but not accounted for separately.

- Reporting during hyperinflation: IFRS has standards for presenting financial statements during hyperinflation, while Vietnam has no requirements on this issue. However, this difference has not significantly affected financial reporting in Vietnam as the country has not experienced hyperinflation

Provisions Regarding Reporting Financial Statements

1. Functional Currency

International Accounting Standard (IAS) 21 clearly defines the functional currency and distinguishes it from the reporting currency. Essentially, the functional currency is the currency used in the accounting records. Vietnamese Accounting Standards (VAS) refer to this but do not clearly specify the difference between the functional currency and the reporting currency.

2. Determining the Relationship between Investor and Investee

When determining the relationship between an investor and an investee, IFRS requires considering the potential voting rights' impact, while VAS only addresses current voting rights without considering potential voting rights.

3. Other Comprehensive Income (OCI) Reporting

IAS 21 requires companies to present other comprehensive income (OCI) either as a separate statement or as part of the income statement. In essence, there are certain items that meet the definition of income or expenses resulting from changes in the size of equity but are not recognized in the income statement. Instead, they are presented in OCI, including:

Revaluation of Fixed Assets under the revaluation model.

Exchange differences arising from translating functional currency to reporting currency.

Gains and losses recognized in an employee benefit program with defined benefits.

Gains and losses from re-measuring the value of financial assets available for sale.

The effective portion of gains and losses on cash flow hedges.

4. Statement of Changes in Equity

IAS 1 prescribes the financial reporting system of a company, including the statement of changes in equity. However, VAS 21 only requires presenting this report as an item in the financial statements' notes.

5. Presentation of Biological Assets, Agricultural Products at Harvest Not Yet Processed, and Long-term Assets Held for Sale

IAS 41 requires that biological assets, such as timber, breeding livestock, or agricultural products at harvest, must be presented separately from inventory and fixed assets. Additionally, IAS 02 and IAS 16 also exclude these assets from their scope.

Due to the lack of Agricultural Standards, biological assets and agricultural products at the harvest under VAS are currently presented either with or as part of inventory or fixed assets.

6. Financial Reporting in Hyperinflationary Economies

IAS has specific standards for presenting financial statements in hyperinflationary economies, while Vietnam has no requirements on this issue. However, this difference has not significantly affected financial reporting in Vietnam as the country has not experienced hyperinflation.